One vital task every business owner must do annually is generate and submit W-2 forms to their employees, the IRS, and other entities. These forms are important because without them, employees cannot complete their tax returns. However, while some parts of the form are fairly self-explanatory, some are not. Understanding what a W-2 is and how to fill one out is necessary. If you fail to send these forms out or make mistakes on them, you can be fined by the IRS or subject to an audit. Let’s look at the basics of a W-2, who needs to receive one, and what information is conveyed so you can always be compliant with IRS regulations and answer any questions your employees may have.

W-2 Basics

The W-2 is a form that the IRS requires every employer to file for every employee that has worked for them during the year. This includes employees who have left and employees who may have only worked a few weeks before the end of the year. Your employees need the information on the W-2 to accurately file their taxes. The IRS uses their copy of employees’ W-2 forms to ensure that the employees claimed the correct amount of income and deductions on their returns and that your company withheld the correct amount of taxes, social security, and other withholdings.

Who Receives a W-2?

Any employee who is on the company’s payroll and paid a minimum of $600 during the year must be issued a W-2 by their employer. Again, it does not matter when the individual worked for the company during the year or if they are currently an employee. The only time the length of an employee’s time with the company affects the need to send a W-2 is if they did not earn at least $600.

You may have paid non-employees to do work for you during the year. These individuals are categorized as contractors or freelancers. Instead of a W-2, you may need to submit a 1099-NEC form. These forms are similar to a W-2 but are designed for non-employees.

Businesses need to submit W-2s in triplicate. One is sent to the employee, one to the IRS, and one to the state the employee pays taxes in (typically their state of residence, but not always). While employee W-2s were traditionally mailed, today companies can make them available online and can submit W-2 information to the government electronically.

When Are W-2s Sent?

W-2 forms are sent out early in the new year. Employers must have all W-2s postmarked or made available online by January 31 each year. Employees should have them in hand by the middle of February so they can file their tax returns before the April 15 deadline. Employers who do not mail out the forms timely can be fined.

Employees who have left a job can ask that employer for their W-2 at any time. The employer then has 30 days to generate the form and deliver it to them. If the employee does not request the form, the employer does not have to provide it until January, even if the employee left the job early in the year.

Why are W-2s Important?

Without a W-2, employees cannot correctly fill out their annual tax return. They need the information provided on the form to determine their gross wages, what was withheld, and other information. The IRS will use the form to make certain the tax return includes the correct figures.

What is Reported on a W-2?

A W-2 form is composed of six lettered boxes, 20 numbered boxes, and several other spaces for information. Some of this is self-explanatory, but other boxes are not as clear. Let’s break down the form into sections and look at what information is reported there.

Boxes a-f: Employee and Employer Information

- Box a contains the employee’s social security number.

- Boxes b and c are for the employer’s EIN/FEIN and the business’s name, address, and zip code.

- Box d lists the employer’s control number. Some companies have a specific control number to help identify items in their system. However, smaller businesses likely do not have this. Box d can be left blank in that case.

- Boxes e and f contain the employee’s name, address, and zip code.

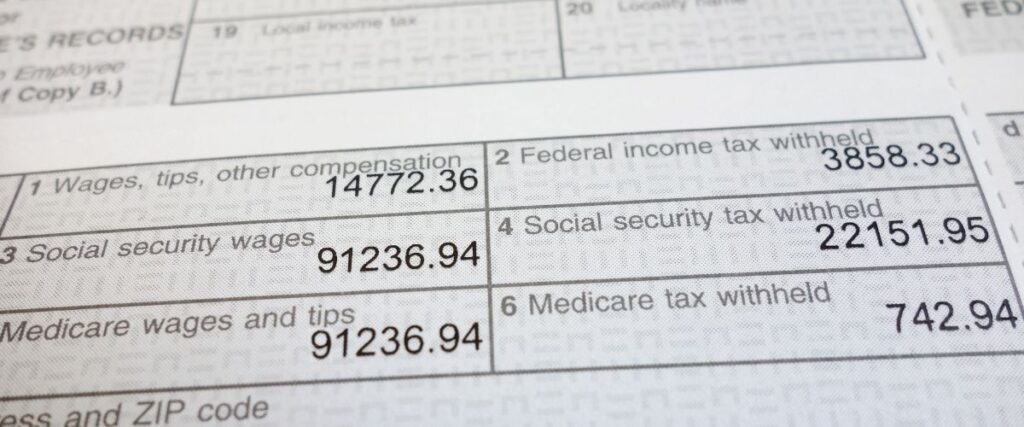

Boxes 1 through 6: Income and Withholdings

- Box 1 includes all of the earnings paid to the employee by the employer. This includes wages, tips, and any other compensation. It does not include anything that is considered a pre-tax benefit like contributions to a 401(k) or life insurance.

- Box 2 is the amount withheld from the employee’s salary for federal income tax.

- Box 3 is the amount of wages subject to social security tax. Only a specific amount of earned income is subject to this tax. That amount is multiplied by a specific amount (6.2 percent in 2021) and reported in box 4.

- Likewise, boxes 5 and 6 list how much of the employee’s income is subject to Medicaid tax and how much was withheld.

Boxes 7 through 14: Other Reported Income and Information

This section may not be as clear if you have not dealt with a W-2 before. This is where having a bookkeeper assist in preparing W-2s can truly help because they understand what qualifies as allocated tips, deferred income, and the other items required here.

- Box 7 is where tips are listed.

- Box 8 lists allocated tips. These are additional tips given to the employee. Employers are only required to allocate tips in specific situations, so this box may be left blank.

- Box 9, Verification Code, is no longer used. It should be blank.

- Box 10 indicates how much was deducted from the employee’s check for insurance for their dependents. These deductions may include matched spending and other benefits.

- Box 11 is for the total amount of money an employee received from a non-qualified deferred compensation plan.

- Box 12 will contain one or more letters. These letters are specific codes for types of income. There are four available boxes (12a through 12d).

- Box 13 is a check box the employer uses to identify if the employee is a statutory employee, contributed to a retirement plan, or received any sick pay from a third-party.

- Box 14 is essentially a miscellaneous box. It is used to report any income or withholdings that do not fit elsewhere.

Boxes 15 through 20: The Remaining Boxes

The bottom line of the form, which includes boxes 15 through 20, is used for state reporting:

- Box 15 – Employer’s state ID number

- Box 16 – Employees wages subject to state tax

- Box 17 – Amount withheld for state tax

- Box 18 – Wages subject to city or other local/state taxes

- Box 19 – Amount withheld for these city/local taxes

- Box 20 – The city/state/other entity that received the taxes from box 19.

Other W-series Forms

In addition to the traditional W-2 form, there are a few special variations that some employees may receive. These forms are typically used to report income in U.S. territories. For example, the W-2AS is used by those who live and work in American Samoa. Other forms in the W-series include the W-2CM (used in the Commonwealth of the Northern Mariana Islands), the W-2GU (used in Guam), and the W-2VI (used in the U.S. Virgin Islands. There is also the form W-2c, which is used to submit corrections to a filed W-2.

One solution to avoid filing a large number of W-2c forms is to work with a payroll provider such as Gusto. This full-service provider does more than just ensure that your employees are paid correctly and on time. They also handle all of their clients’ W-2s, 1099s, and other tax forms. If you do not want to worry about filling out W-2s yourself, you may want to consider working with one of these services.

Differences Between a W-2 and a W-4

When an employer hires someone, one of the first things this new employee should do is fill out a form W-4. This form is what the employer uses to determine how much to withhold from the employee’s paycheck. The employee will enter their number of dependents on the W-4 plus indicate any additional amount they want withheld from each paycheck. The employee can make changes to their W-4 at any time. For example, it should be updated if the employee gets married, has a child, gets divorced, or if they determine they want to change their additional withholding amount.

The W-2 and W-3

In addition to submitting a W-2 to the Social Security Administration, employers also submit a W-3. This form summarizes the employee’s wages and the amount they contributed to social security. It is used by the Social Security Administration to reconcile the amount received. Employees do not receive a copy of this form.

Protea Financial Can Help You Prepare W-2s and Avoid Fines

If you are new to paying employees, you want to make certain your W-2s are generated correctly and made available to employees before the deadline. For that, you need a professional. Protea Financial can assist you in preparing W-2s and with any other bookkeeping need you may have. Contact us today to learn more about virtual bookkeeping and what we can do for you.

For help understanding a W-2, how to fill it out, or what you need it for, please contact us. We are here to help!

Electronic Filing Changes

Starting in 2024, if you’re filing 10 or more W-2s, you’ll need to do it electronically. This is a big shift from the old 250-form threshold. So, even small businesses with a handful of employees are now on the e-filing train.

Common Mistakes to Watch Out For

Nobody’s perfect, but some common W-2 errors pop up more often than others. Here are a few to keep an eye on:

- Employee Info Slip-Ups: Make sure names and Social Security numbers match exactly what’s on their cards. A tiny typo can lead to big headaches.

- Employer Details: Double-check your company’s name, address, and EIN. Consistency across all tax forms is key.

- Benefit Overages: Keep an eye on contributions to retirement plans and HSAs. Going over IRS limits means extra steps to fix things.

- Formatting Fumbles: Use black ink, include cents (like 1000.00), and skip the dollar signs. It sounds picky, but the IRS cares about these details.

- tate-Specific Stuff

Different states have their own quirks when it comes to W-2s. For example, some require reporting of certain benefits or have unique tax credits. It’s worth checking your state’s guidelines to stay compliant.

Key Dates

Don’t forget, W-2s need to be in your employees’ hands and filed with the SSA by January 31, 2025. Mark your calendar to avoid any late fees.