This blog post was originally published in December 2021, but we wanted to take the time to update and improve the information we offered. We recently updated it in November 2022.

If you do any type of contract or freelance work for a company, that company may be required to send you a form 1099. This is a tax form required by the IRS to report income for those who are not employees but still do work for and are paid by a company. However, while contractors often receive 1099s, they are not the only people who may get this document. Let’s go over the various types of 1099s, what one contains, why you may get it, and what you do with this document.

What Is a 1099?

Any time you are paid for work by a company, that company is required to report your payments to the IRS as income. Typically, this is done through a form W-2 because most, if not all, of the company’s payments go to employees. However, some companies do hire contractors or freelancers. These individuals work on specific projects for a set amount of pay. They typically receive no benefits such as insurance or paid time off. However, they are often free to work at home and on their own schedule. Once the project is complete, they receive their payment and move on to their next job, though they and the company may also agree to a new contract for further work.

When a company pays one of these contractors, the income is reported on a 1099. It’s similar to a W-2, but there are a few significant differences. The size of the company, their industry, or the type of project does not play any part in a 1099. All companies, even small businesses, must issue 1099s to a contractor who did work for them.

However, according to IRS rules, a company only has to issue a 1099 if they pay a contractor more than $600 within the calendar year. This means a company that paid a contractor $500 is not required to send them a 1099. Contractors who receive one of these forms do need to include that income in their annual tax return just as they would report income earned on a W-2.

In addition to receiving a 1099 for contract work, you may also receive a 1099 for capital gains distributions, interest payments, dividends, and other income. The type of income will determine the type of 1099 form that you receive. There are a number of types of 1099s, including the 1099-MISC, 1099-R, and 1099-C.

What Information Is on a 1099?

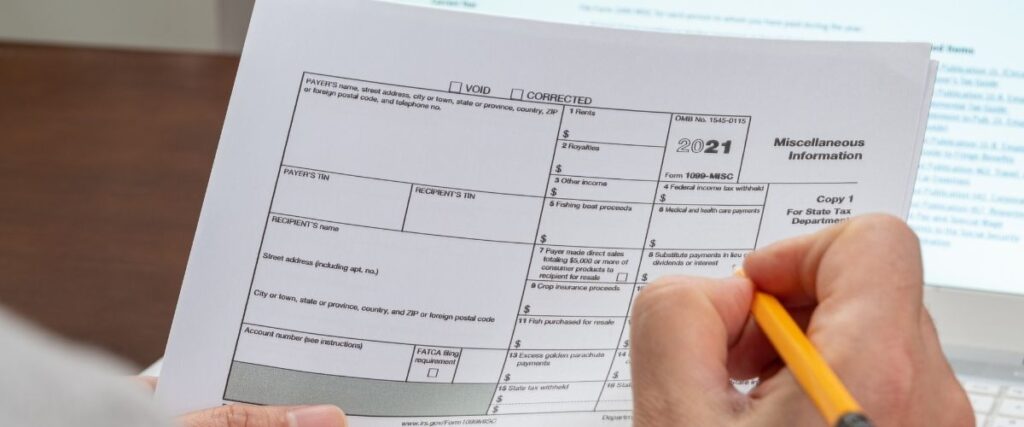

A 1099 includes much of the same information as you would find on a W-2. This includes the following:

- The contractor’s full name, address, and social security number or taxpayer identification number.

- The company’s name, address, and FEIN (or SSN if they are paying as an individual).

- The total amount of money paid throughout the year.

- The account number.

- The total amount of federal and state income tax withheld, if any (typically this is zero for a 1099).

- The state or payer’s state number.

- The amount of state income.

As with W-2s, the company will fill out the 1099 and mail a copy to both the contractor and the IRS. The contractor will need to review the information and contact the company right away if there are any mistakes.

When to Expect Your 1099

The 1099 form is an IRS document that reports the income you received from a company or individual during the tax year. If you are an independent contractor, freelancer, or self-employed person, you should receive a 1099 form from each client or customer who paid you $600 or more during the year. You will use the information on your 1099 forms to complete your federal income tax return.

You should receive your 1099 forms by January 31st. If you do not receive a 1099 form from a company or individual who paid you $600 or more during the year, you will still need to report that income on your tax return. You can get copies of your 1099 forms from the IRS, if necessary.

If you are expecting to receive a 1099 form, be sure to keep track of your income throughout the year so that you can accurately report it on your tax return. That way, when you start your taxes, you have accurate data to pull from.

Why Are 1099s Issued?

Any contractor or individual who receives over $600 a year from a business, financial institution, or other payer will be issued at 1099. The IRS requires this income to be reported, and there are no exceptions. A company or other payer who fails to submit a 1099 form will face fines from the IRS. Individuals who do not report this income may be subjected to audits and fines as well.

Individuals who own stocks, receive interest on accounts, or are paid other types of income that is not classified as a wage will also receive a 1099 if they made more than $600. Typically, these forms will come from the payer. However, starting in 2021, some online payment processors such as PayPal may issue a 1099 to those who receive over $600 from the same payer. There are still many questions about how this will affect contractors, businesses, and others who receive payments through these processors.

How a 1099 Differs from a W-2

The main difference between a W-2 and a 1099 is that a W-2 lists out the various taxes, social security, and other withholdings from an employee’s paycheck. While a contractor may have taxes withheld on a 1099, typically this is not that case. That means the contractor or other individual will need to pay taxes on that money as part of their annual income tax return.

The two forms are similar in that both W-2s and 1099s are generated and sent out in January. Contractors, individuals, and employees should receive these forms by February first. If they do not, they will need to contact the payer. Contractors may receive 1099s from every company they have worked with over the year, while individuals may receive 1099s from every financial institution that paid them interest or dividends.

It’s also possible for someone to be an employee and do contract work. In this case, they will have both a W-2 and at least one 1099 to file.

How to Pay Taxes on a 1099

If you’re a freelancer or contract worker, you may be used to getting a 1099 at the end of the year. This document is important because it shows how much money you made during the year. It’s also important because it’s required for filing your taxes.

The first thing you need to do is get organized. Gather up all your 1099s and put them in one place. Once you have them, look at each one and make sure the information is correct. If anything looks off, contact the issuing company right away to get it corrected.

Next, you need to calculate your total income for the year. Add up all the money listed on your 1099s. This is your gross income for the year.

Now it’s time to figure out your deductions. These are expenses that can be subtracted from your gross income to arrive at your taxable income. Common deductions for freelancers include business expenses such as office supplies, website hosting fees, and mileage if you use your personal vehicle for business purposes.

Once you’ve calculated your taxable income, you can use tax software or consult with a tax professional like we have here at Protea Financial to determine how much tax you owe. Be sure to pay any taxes owed by the tax deadline to avoid penalties and interest charges.

Paying taxes as a freelancer or contract worker may seem daunting, but it doesn’t have to be complicated. By gathering up all your 1099s, calculating your gross and taxable income, and subtracting any deductions, you can easily determine how much tax you owe for the year.

What Information Do You Need to File a 1099

To file a 1099, you will need the following information:

- Name and address of the recipient

- Amount of money paid to the recipient

- Date the payments were made

- Type of 1099 form you are filing

If you are e-filing, you will also need to include your PIN

How Do the Types of 1099s Differ?

There are many different 1099 forms. All of these forms are used to report income other than wages earned as an employee. However, each one is slightly different in what income it is used to report. Here are some of the most common types of 1099s:

- MISC – The 1099-MISC was the form used to report payments made to contractors and other freelancers. However, the form was also used to report other payments, including prize money, payments made to attorneys, rent, and other miscellaneous income. It is no longer used for contractors as of 2021.

- NEC – The 1099-NEC replaced the 1099-MISC for contractor payments starting with tax year 2021. It lists all non-employee income received in exchanged for services. This is the form that contractors and other freelancers will typically receive. Contractor payments were split out from the 1099-MISC to address certain loopholes.

- DIV – Individuals who own stock or other types of securities and are paid more than $10 in dividends or distributions will receive a 1099-DIV to report that income to the IRS.

- INT – The 1099-INT is issued by banks and other financial institutions. It reports interest of over $10.

- R – Those who receive distributions from a retirement account such as a 401(k) or a Roth IRA will receive a 1099-R stating the total amount of the distributions taken that year.

- C – This is a special type of 1099 that is only used when an individual settles debt with a credit issuer for less than the amount owed. Typically, this is done during the bankruptcy process, although it could also be done via other types of negotiations. This form shows the amount of forgiven debt, which is not typically taxed as income. However, it still must be reported.

- Q – A 1099-Q is used to document income received from a 529 educational plan or Coverdell ESA. This form is

- G – The 1099-G form is used to report several different types of payments. It’s commonly used to report unemployment compensation, but it can also be used to document income tax refunds from the state or local government as well as agricultural payments and income from taxable grants.

- SSA-1099 – Those who receive social security payments will receive a SSA-1099 form every year detailing the total amount of SSA payments they received that year. This is one of the few 1099 forms in which the identifying letters come before the form number.

- K – A 1099-K is issued by a third-party payment processor such as PayPal when an individual or business has more than 200 online payment transactions that total over $20,000. Credit card payment processors may also issue 1099-K forms.

- B – Individuals who sell stock will receive a 1099-B from their mutual fund company or brokerage. This form details the date the stock was sold, the cost of it, and the amount it was sold for.

Pros and Cons of Being a 1099 Worker

As an independent contractor, you are responsible for paying your own taxes. This means that you will need to save money throughout the year to ensure that you have enough to pay your taxes come tax time. Additionally, 1099 contractors are not always eligible for unemployment benefits, so if you find yourself out of work, you will not have any safety net to fall back on.

On the other hand, 1099 contractors have a lot of freedom and flexibility when it comes to how they work. You can often set your own hours and work from home, which can be a major perk. Additionally, you may be able to negotiate a higher rate with your clients since you are not paying into unemployment or other benefits.

Common Mistakes When Filling Out Your 1099

There are a few common mistakes that people make when filling out their 1099 forms, which can lead to some pretty serious consequences. Here are a few of the most common mistakes:

- Not including all oyour income: This one is pretty straightforward – if you don’t include all of your income on your 1099, you’re not going to get credit for it come tax time. Make sure to double check that you’ve included everything you need to, or you could end up owing the government a lot of money.

- Incorrectly calculating your deductions: This is a mistake that can cost you big time. Be sure to take your time and calculate your deductions correctly, or you could end up overpaying (or underpaying) your taxes.

- Not keeping good records: This is important for a few reasons. First, if the IRS comes knocking, you’re going to want to be able to show them exactly what you did and how you did it. Second, even if the IRS doesn’t come calling, good records will help you keep track of everything come tax time so that you can be sure you’re getting all the deductions and credits you’re entitled to.

- Filing late: This one can also cost you, in the form of late fees and penalties. Make sure to file your 1099 on time so that you don’t have to worry about these extra charges.

- Not understanding the form: Not understanding what the form wants or needs from you is another common mistake. It can lead to open spots or inaccurate information. The best thing to do if you do not understand the form is to ask someone who can help guide you through the process. Not filling out a 1099 properly because you misunderstood something is not going to allow you to bypass the potential consequences from the IRS.

Risks of Not Filling Out Your 1099 Correctly

If you’re a business owner or independent contractor, you’re probably aware that you need to fill out a 1099 form for any contractors or vendors you’ve paid $600 or more during the year. What you may not know is that there are some serious risks associated with filling out this form incorrectly.

The first and most obvious risk is that you could end up owing the IRS money if you don’t report all of the income you’ve received. This could result in interest and penalties, and could even lead to an audit.

Another risk is that you could inadvertently misclassify someone as an independent contractor when they should be classified as an employee. This could come back to bite you down the road if the person decides to file for unemployment benefits or sue you for wrongful termination.

Finally, if you make any mistakes on your 1099 forms, it’s possible that the IRS could come after you for back taxes, interest, and penalties. So it’s important to double-check your work and make sure everything is accurate before sending in your forms.

If you have any questions about how to fill out your 1099 forms correctly, don’t hesitate to reach out to a tax professional for help.

What Are the Penalties for Not Filing a 1099?

If you don’t file a 1099, the IRS can assess a penalty of up to $280 per 1099. The penalty is based on when you file the 1099 and how many 1099s you must file. The penalties are:

- $50 per 1099 if you file within 30 days of the due date

- $110 per 1099 if you file more than 30 days after the due date but before August 1

- $280 per 1099 if you file on or after August 1

As a Business, You Need to Have Your 1099 Forms Prepared Correctly

It goes without saying that any business that issues 1099s must make certain that the forms are prepared correctly and are issued on time. Being late can result in fines, while sending out incorrect forms can cost you time and money in correcting and resubmitting them. Fortunately, most businesses will only need to deal with one or two types of 1099s.

While a 1099 is a fairly simple form to fill out, you will still need a professional bookkeeper on your side to make certain you submit the correct payment amount to the right contractor or other individual. If you don’t have a bookkeeper of your own, you may want to work with a virtual bookkeeper. These experts are just as skilled and knowledgeable as local bookkeepers.

The team here at Protea Financial is ready to assist you with all of your bookkeeping and other financial needs. We can track contractor payments, assist with 1099s, and much more. Contact us today to discuss how we can help you.

If you still want help understanding a 1099 or what it is used for, then reach out to us here at Protea Financial. We are here to help!