The accounting equation is the most important piece of information any accountant can learn. Anyone starting out in the field of accounting or wants to just better understand the account equation should take time and learn the equation.

It really a very simple formula.

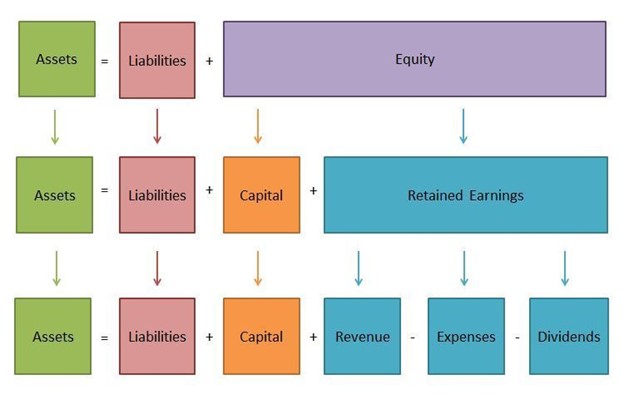

Assets = Liabilities + Equity

This straightforward equation on a company balance sheet is the foundation of the double-entry accounting system and the basics of accounting. Double entry accounting is the term used to simply summarize that each debit (left hand side) has an equal credit (right hand side), that keeps the books in balance. The accounting equation is the reason your balance sheet remains balanced.

It is all you need to handle the basics of accounting, and most of the not so basic items as well. Yes, there are a lot of overly complicated standards and yes, these do add extreme complexity, but at the core, if you know this equation, apply this equation and live by this equation you are bound to succeed.

In the expanded view, equity is broken down into capital and retained earnings.

Capital is the funds put into the business. Retained earnings is a little bit more complicated but in basic terms it is your revenue less your expense and further reduced by any funds owners have taken out of the business (can be in the format of dividends).

Understanding the Accounting Equation an Its Components

If you are trying to understand the financial position of a business the first place you want to go is to the balance sheet. Though each of the three main financial statements in accounting—the balance sheet, income statement, and cash flow statement—can stand on its own, there’s one piece of the puzzle that ties them all together: the accounting equation.

The equation makes it possible to figure out any one value using the other two values and vice versa, so you can use it to solve problems quickly and easily without needing to start from scratch every time.

As mentioned, the balance sheet is the accounting equation and will quickly show you all the key components of your business, namely your assets, your liabilities and if the company is profitable (though might be a bit hard to see as the equity section is a bit more complicated).

Assets are the items of worth that the business controls and liabilities show you what the business owes to others.

Understanding the Balance Sheet

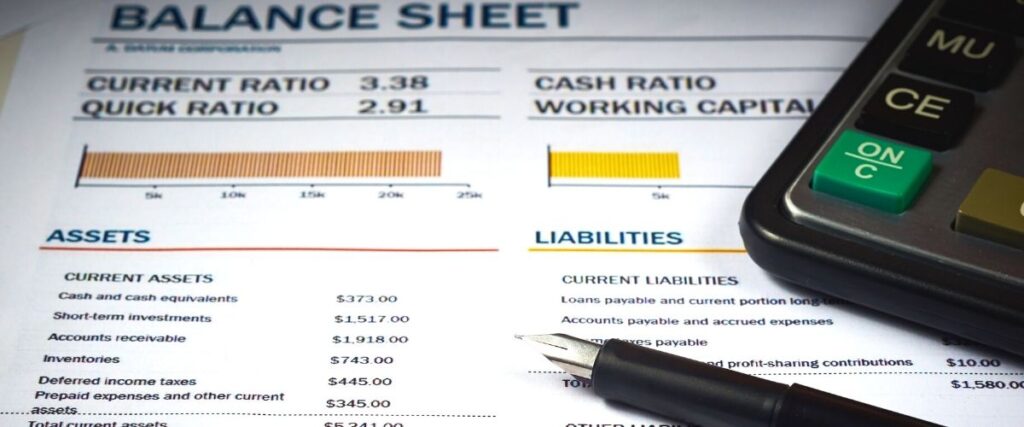

Every business keeps its assets and liabilities in check by tracking them on their balance sheet. The total value of all your assets is tracked at one side of a balance sheet, while your liabilities (the amount you owe to others) are listed at another column.

The third, and final, component of a company’s balance sheet is owner’s equity, which includes common stock and retained earnings. To be able to understand how a balance sheet works, you must know what each component means.

When looking at a balance sheet, you will see both current and noncurrent assets. this definition means they can be turned into cash within 12 months or less. On top of that, you will also see financial ratios like debt to equity ratio, working capital ratio, and asset turnover ratio.

These ratios help us to know whether or not a company has enough liquid capital to pay off debts with ease and has an excess of money left over for expansions. The only way that investors can see the information is by a spreadsheet or at a company’s webpage.

These numbers help them to decide whether or not they should invest in the company. to decide whether or not to invest, the company needs to take into account how much debt it has and how much the owner has.

Understanding the Cash Flow Statement

An investor needs to look at more than just a company’s income statement (aka profit and loss) and balance sheet (aka assets and liabilities). Cash flow statements are also important for understanding how a company is performing, since they provide insight on whether it can meet its short-term financial obligations.

While cash flow statements may not always be as straightforward as others, they have a very logical format. The first section of any cash flow statement will reveal where a company’s cash comes from and what types of assets generated that money. This is typically followed by an analysis of how much money was spent in each category, like dividends or capital expenditures.

Finally, investors should take note of items like net change in cash—this shows if a company has enough liquid assets to keep up with its current obligations. It’s best to view a cash flow statement over time so you can see trends in different areas and compare companies against one another.

Call Us Here at Protea Financial to Learn More About the Accounting Equation

The accounting equation is simply the most important accounting basic you will ever learn. It has several components that are all important. To find out more about the importance of the accounting equation, or any of its components, please call Protea Financial today!

Reach out to the professionals here at Protea Financial to fully understand the accounting equation and its components!