A balance sheet is a financial statement that provides an overview of the company’s assets, liabilities, and equity at a specific point in time. It is important to know what each one means in order to understand how well you’re doing. It can be difficult to understand all the information on this document, but there are ways to break it down into more manageable pieces.

What is a balance sheet?

The balance sheet is a financial statement that provides information about the assets, liabilities, and equity of a company.

The first section of the balance sheet lists the assets on hand. Assets are anything that can be turned into cash. Assets include cash, accounts receivable (money owed to you), inventory (goods waiting to be sold), and prepaid expenses (e.g., insurance that is paid annually in advance). Assets are usually broken up into short-term (less than one year) and long-term (one year and longer)

The second part lists liabilities, which are things you owe money for. Liabilities include loans payable or due for goods purchased on credit. Like assets, liabilities are usually broken up into short-term and long-term.

Finally, equity is calculated by subtracting what you owe from what you own. This is also referred to as net worth or the net value of the business.

The importance of the balance sheet

Balance sheets are a snapshot of what a company’s assets, liabilities, and equity look like at any given point in time. A balance sheet is a tool that can be used to find out if a company has enough money to cover its obligations and stay afloat or enough assets to cover its long term obligations.

The balance sheet can also be used to determine how a company is financing its operations. A company that is generating enough net income will have higher retained earnings from one year to the next. A company that is financed through debt will have an increase in long-term liabilities year-over-year.

How to read a balance sheet

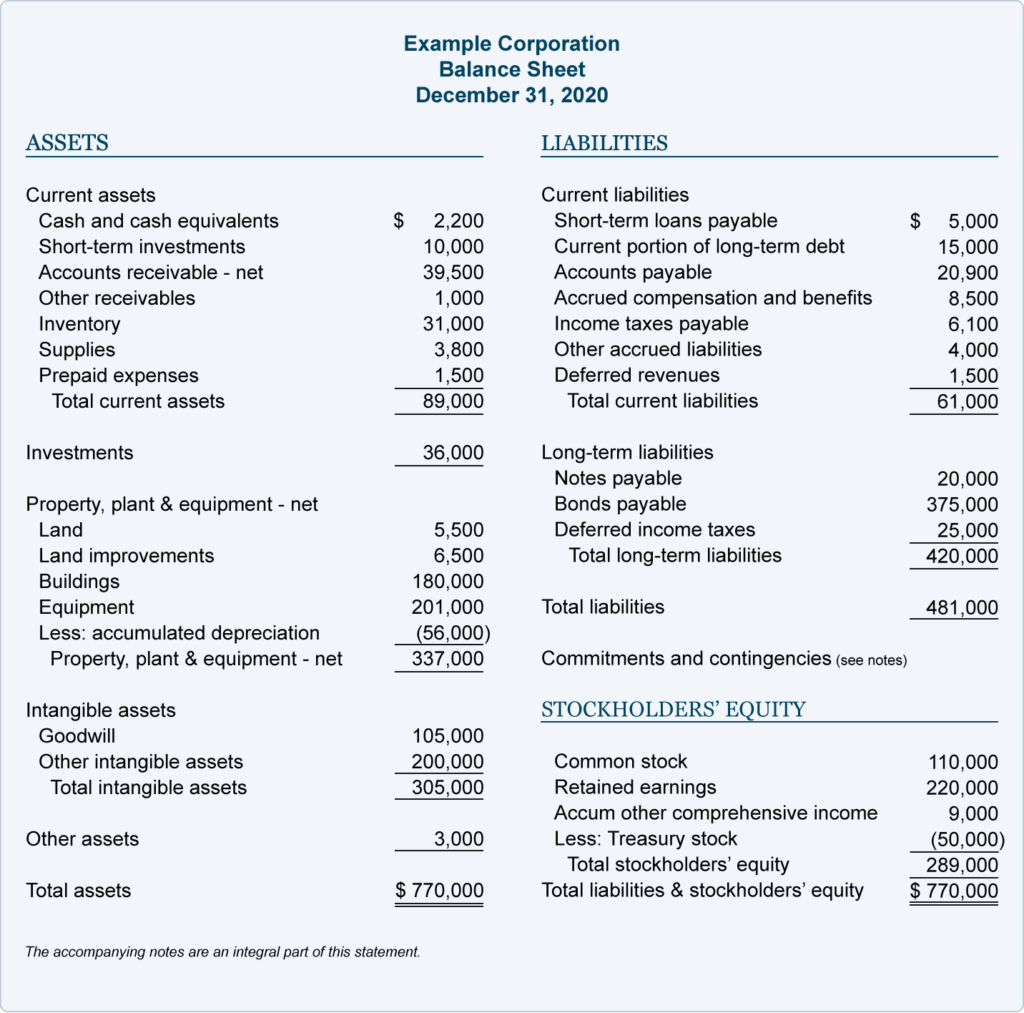

Below is an example of a balance sheet.

We already explained assets, liabilities, and stockholder’s equity. The balance sheet must always “balance” because assets equal liabilities plus equity (known as the accounting equation). Understanding this equation helps you understand a company’s position. If the company has more liabilities than assets, then it will have negative equity, which is a potential major red flag especially with mature businesses.

Investors and creditors like to determine a company’s financial health using something called ratio analysis. To determine how liquid a company is, divide current assets by current liabilities. In the example above, 67,500 / 34,200 = 1.92. Whether that is good or bad depends on the industry. In general, anything near or over 2.00 is acceptable.

Other performance indicators include solvency ratios (also called financial leverage ratios), profitability ratios, efficiency ratios, and coverage ratios. Corporations also have market prospect ratios which are used to predict performance, which is imperative when valuing a company’s stock price.

How to use information from the balance sheet to improve your finances

Did you know the information found on a balance sheet can also be used to measure your company’s vulnerability to risk? A complete balance sheet includes key pieces of information like cash on hand, accounts receivable and inventory. By analyzing these numbers, you will be able to see where your business is strong or weak in relation to other companies in similar industries. If there are any areas for improvement (i.e., too much debt), it will allow you time to prepare so that when the unexpected happens.

If you want to take control of your finances and improve them, the balance sheet is a good place to start. Understanding what it includes and how to read one will provide insight into where you can make changes in order to get more money for yourself or avoid unnecessary expenses that are taking too much from your paycheck.

The best way to use this information is by comparing two different months side-by-side on paper so that you have everything at hand. Once you have done this, focus on adjusting only those areas which seem most important – like lowering debt payments or reducing inventory on hand – and see if there is an impact in your bottom line!

The balance sheet is a powerful financial tool that can be used to improve your finances. It’s important for you to understand how the information on the balance sheet works and what it means in order to make informed decisions about improving your money management skills. Let us know if we can help! Contact our team of experts today and let them show you how they have helped others grow their wealth with remarkably simple math.

FAQs on Understanding Balance Sheets for Better Financial Management

What exactly is a balance sheet and why is it important for my business?

A balance sheet is like a financial snapshot of your business at a specific moment, showing assets, liabilities, and equity. It’s crucial for understanding your financial health, identifying strengths and weaknesses, and making informed decisions to improve your business’s financial management.

How do I read a balance sheet and understand its components?

Reading a balance sheet involves understanding assets (what you own), liabilities (what you owe), and equity (the net value of your business). The balance sheet always balances because assets equal liabilities plus equity, showcasing your business’s financial position.

Can you explain how to use information from a balance sheet to improve my finances?

Absolutely! By analyzing key components like cash, accounts receivable, and inventory, you can identify areas for improvement in your business’s financial management. This allows you to make informed decisions, reduce unnecessary expenses, and maximize profitability.

What are some key ratios and performance indicators derived from a balance sheet?

Ratios like liquidity, solvency, profitability, efficiency, and coverage provide valuable insights into your business’s financial performance. For instance, the current ratio (current assets divided by current liabilities) indicates your liquidity, with a ratio of around 2.00 considered acceptable in most industries.

How can I measure my company’s vulnerability to risk using a balance sheet?

A thorough analysis of your balance sheet reveals your business’s exposure to risk factors like debt levels and inventory management. By identifying areas of weakness, you can proactively mitigate risks and safeguard your business against unforeseen challenges.

Why is it essential for businesses to compare balance sheets over different time periods?

Comparing balance sheets over time allows businesses to track their financial progress, identify trends, and evaluate the effectiveness of financial strategies. It provides valuable insights into areas of improvement and helps businesses adapt to changing market conditions.

What role does the balance sheet play in attracting investors and creditors?

Investors and creditors rely on balance sheets to assess a company’s financial health and stability. A well-maintained balance sheet demonstrates transparency, financial strength, and potential for growth, making your business more attractive to potential investors and creditors.

How can understanding balance sheets help me make better financial decisions?

Understanding balance sheets empowers you to make informed financial decisions by providing insights into your business’s financial position, strengths, and weaknesses. It allows you to allocate resources effectively, manage risks, and maximize profitability.

Are there any common pitfalls or challenges associated with interpreting balance sheets?

One common challenge is overreliance on historical data, which may not accurately reflect future trends. It’s essential to consider external factors and market dynamics when interpreting balance sheets to avoid making decisions based on outdated information.

Where can I get expert guidance on interpreting and utilizing balance sheets effectively?

If you’re seeking expert guidance on balance sheets and financial management, our team of experts is here to help. Contact us today to learn how we can assist you in deciphering balance sheets, improving financial performance, and achieving your business goals.

Let’s unlock the power of balance sheets together!

UPDATE: Understanding the Balance Sheet: Key Components Explained

A balance sheet provides a clear snapshot of your business’s assets, liabilities, and equity at a particular moment. Knowing what each element represents is essential to gauge the financial health of your business. This document might seem overwhelming, but by breaking it down, you can analyze and leverage its insights for better decision-making.

Assets: What You Own

The asset section of a balance sheet lists everything your business owns that can be converted to cash. These include cash, accounts receivable, inventory, and prepaid expenses. Assets are often divided into short-term (convertible within a year) and long-term (convertible after a year). This categorization helps in understanding liquidity and resource allocation.

Liabilities: What You Owe

Liabilities represent your business’s debts, which can be in the form of loans or credit purchases. Like assets, liabilities are typically divided into short-term and long-term obligations. Understanding your liabilities is crucial for managing debt and assessing the company’s financial leverage.

Equity: What’s Left for Owners

Equity is calculated by subtracting liabilities from assets, representing the net worth of your business. It’s also known as the owner’s or shareholder’s equity. Positive equity indicates financial stability, while negative equity may be a warning sign, especially for established businesses.