The regulators taking over Silicon Valley Bank and the speed at which it happened shocked many of us. As employers navigate the ongoing volatility and uncertainty in the markets – businesses can take measures to:

- Increase their liquidity.

- Diversify their service providers and suppliers.

- Protect their systems/data.

- Put risk management and insurance protection in place to help safeguard their businesses.

We often talk about business best practices, but what about employee financial best practices?

The market volatility, high-interest rates, inflation, and rapidly increasing debt, are prevalent and affecting everyone. And your employees? They feel the financial pressure, too.

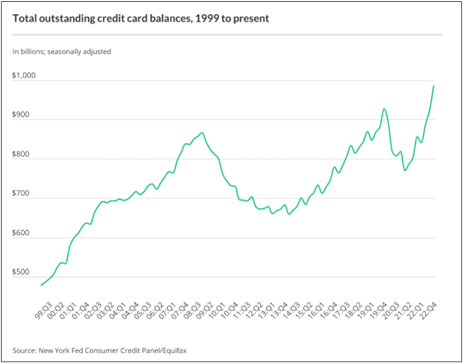

With widespread inflation, credit card debt is accelerating and has reached record levels, pictured below. Lending Tree reported $986 billion in credit card debt in Q4 2022 – $59 billion higher than the record reported in Q4 2019. Not only has debt increased, so has the cost, with Forbes Advisor reporting average credit card interest rates at 24% (as of March 8th, 2023).

Employees are estimated to spend ~25% of their workweek worrying about money. Water cooler talk? It doesn’t typically involve conversations around personal finances and debt. There are many complex emotions around money, and just talking about finances and debt can be embarrassing and taboo. When employees grow quiet and lose focus on their work – could financial stress be what is distracting them?

So, what can employees do to relieve money-associated stresses and be fully engaged at work?

Build Savings and Liquidity

- Pay off high-interest rate debt should be a top priority, starting with the highest interest rate debt first. By reducing spending where possible and prioritizing and paying off this debt, monthly cash flow and the ability to save improve, thereby decreasing stress levels and “lightening that mental debt load.”

- Build up liquidity in an emergency fund – we’ve all had unexpected financial events arise, and being financially prepared for new tires for your car or a major home repair helps avoid credit card debt and keeps those stress levels in check. Everyone’s financial and job situation is unique, so the target emergency fund amounts will vary from person to person. A general rule of thumb is a minimum of 3-6 months of expenses for an emergency fund.

- Invest, even if it’s a small amount. Over time, that investment can grow substantially.

For example, employees who receive tips in hospitality roles – even saving $20 from each work shift adds up significantly over time – it is the magic of compounding, and the longer that money works, the better.

Diversification and Risk Reduction

1. Bank & Investment Institutions– diversify exposure by having more than one bank and investment account provider, reducing company-specific and cyber-related risk.

2. Investment Accounts– it is common for employees to invest in 401ks and retirement accounts using pre-tax dollars. Retirement accounts have withdrawal penalties and taxes that must be paid for early withdrawals. (Roth IRA withdrawals can be an exception). Saving in a brokerage account with after-tax dollars is also important as it provides flexibility in withdrawals if investment funds are needed before retirement.

3. Investing Strategies– investing across asset classes (bonds vs. stocks, etc.) and in diversified funds, like the S&P 500 stock index fund, reduces overall investment risk.

The Silicon Valley Bank Financial Group stock is an example of single stock risk – upon rapid decline, trading was halted by the government, and the stock went from $267/share to being worthless in 48 hours, a significant and unexpected loss for many.

There can be much hype around buying individual company stocks, but being diversified reduces overall risk vs. highly concentrated positions and portfolios.

Proactive Measures for Estate Planning & Protection

1. Designate a trusted person to know where the bank, investment, retirement accounts, and insurance policies are located. If something happens, loved ones know where to go and access funds/insurance policies as needed.

2. Check credit reports annually. Data breaches occur, and account information can get into the wrong hands. If there is any unexpected account activity or erroneous information in the report, contact the credit bureau and account provider directly. The government provides a free credit report check once a year. It can be found here: www.annualcreditreport.com.

3. Ensure beneficiaries are up-to-date with insurance policies and 401k/retirement, bank, and investment accounts, allowing a smooth transfer to the recipient. (Often referred to as Transfer on Death (TOD) and Payable on Death (POD) designations).

4. Establish estate planning documents:

- Will – communicates final wishes for children under 18, pets, where property goes, and service/burial wishes, etc.

- Trust – used for directing and transitioning assets. Trust assets can avoid a lengthy probate process and help retain privacy while transferring assets to beneficiaries.

- Power of Attorney – for medical care and finances – designate someone with medical and financial authority when unable to act.

5. Review insurance policies to ensure adequate liability and property coverage, as coverage needs can change over time.

Financial planning is not just about investing. Building liquidity, diversification, and proactive planning and protection help create a more well-rounded financial picture. Providing financial wellness and educational support can be very impactful for employees. It gives them the knowledge to improve their financial outcomes – leading to less stress, improved mental and physical well-being, increased loyalty, workplace productivity, and engagement.

For prosperity to happen, we need to be bold, we need to work together, and we need to talk about money more. Are you with me?

Tracy Baron Garcia founded TBG Prosperity – she uses her financial planning, wealth management, and corporate retirement plan experience to provide 1:1 financial planning and financial education sessions to empower people to improve their financial future and create financial security now and in retirement. She is determined to help create financial opportunities for all and make money less taboo and less intimidating, especially for those working in the hospitality, non-profit, and service sectors.

By setting up your employees for financial success, it also sets up your business for success, both financially and reputationally. Let Protea Financial help your business go the right direction!