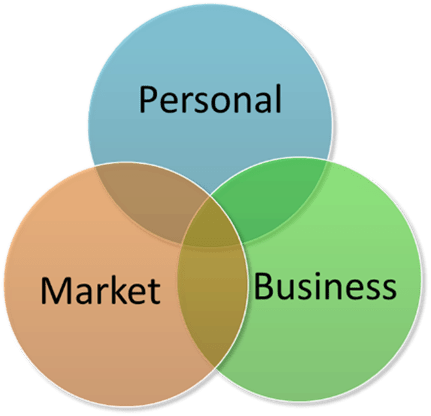

Business owners often ask, “When is the right time to sell my business?” The answer is some version of “A good time to sell is when there is a seller’s market, and the owner and the business are prepared”. Simple enough, but there is a lot to unpack in this response.

Don’t Try to Time the Market

A seller’s market exists when, because of economic conditions, demand for viable businesses is higher than the supply of businesses on the market. There are some universal economic metrics that drive demand for businesses like low interest, tax rates and high corporate cash reserves and earnings rates. When investors are confident about the business environment, they are more likely to pay premiums for their investment targets.

However, local and industry specific factors are often more important to the creation of a seller’s market. A mature industry that begins to consolidate may create an industry-specific seller’s market that doesn’t exist in other industries. The rise of private equity has driven consolidation in many industries. Also, when a regional competitor embarks on an acquisition growth strategy it may create a localized opportunity for owners in the same industry to sell.

It is wise for a business owner to pay close attention to these market signals. However, owners can’t control supply and demand in the marketplace and are generally better off not trying to time the market. In the second quarter of 2020, the market for small businesses came to an abrupt halt, dashing the hopes of many owners that were ready to retire. But by the fourth quarter of the same year the market returned stronger than before. No amount of prognosticating could have anticipated those market changes.

Business Preparation is Key

The preparation of the business is more important to the success of the business sale than the state of the marketplace, and it’s something that the business owner can control. A well-prepared business is more likely to sell in a soft market, than a poorly prepared business in a strong market.

It’s been estimated that 80% of US small business owners don’t have a written transition plan and 50% have no plan at all. A key component of the transition plan is preparing the business for succession. Many books have been written and teams of professionals deployed to help business owners prepare their businesses for sale. Conceptually, the buyer of a business is investing with the confidence that the future earnings and growth potential enjoyed by the seller can be transferred to the buyer. To make the business attractive, the owner must then mitigate the risks in the business and to fortify its opportunities for growth. The specific measures necessary to prepare the business vary widely. Some critical areas for consideration are:

- What are the growth prospects of the business? Is there a viable pathway to achieve growth?

- What constitutes the goodwill of the business? Is the goodwill persistent and can it be transferred to a buyer?

- Is the business’ intellectual property sufficiently protected?

- What is the owner’s role in the business? How easily can the owner be replaced?

- Does the remaining management team have the experience and resources necessary to operate the business efficiently?

- Is the business properly staffed for its size and to recognize its growth potential?

- What supplier and customer risks exist? How can they be addressed?

- Do the business assets have deferred maintenance or unfunded capital expenditures?

There are times when a business is clearly not ready to be placed on the market. The business may not be performing because of loss of an important client, vendor, or key employee or because of an acute business issue that the business is facing like a lawsuit or a loss of facility lease. These red flag issues should be resolved by the owner, before trying to sell their business.

The process to identify and address the specific issues faced by a company may take 3-5 years, so it’s important to plan ahead. But the owner of a company that has been properly prepared for sale, may be rewarded with a price premium, while an unprepared business may sell for a discount, or not at all.

The Owner is Motivated, but not Compelled to Sell

Lastly and most importantly, the owner needs to be psychologically ready and financially prepared to exit their business. Most owner’s only own one business in their life and selling it is momentous. For some, the business is tightly intertwined with their personal life and identity. However, there inevitably comes a day when the owner no longer wants to or no longer can be involved in the business.

Owner’s end up selling for a variety of reasons, for some it’s poor health, for some its divorce from their life or business partner. These personal challenges can make the process of selling the business more difficult and may put the owner at a disadvantage during negotiations with a buyer. The best reasons are because the owner realizes that there is something that they would rather be doing with their time or assets like retirement or another venture. Ideally, they are personally motivated, but not compelled to exit.

Even if the owner is determined to sell, they may hesitate to do so if they haven’t determined that the proceeds from the sale are sufficient to support their retirement or pursue other ventures. Professionals can help with this analysis. Business appraisers can help to anticipate the proceeds from selling the business. While a financial planner can help an owner estimate the amount needed to support their retirement.

Ultimately, determining the right time to sell their business requires the owner to plan ahead and prepare the business for the time when market conditions are adequate, and the owner is personally motivated. Exit Strategies Group helps owners to plan for and execute their business exits. If you’d like help in this regard or have any related questions, you can reach Adam Wiskind, Certified Business Intermediary at (707) 781-8744 or awiskind@exitstrategiesgroup.com.

If you plan to sell your business, then make sure you have everything in order to make the process easy. Reach out to have help getting your books in order to show potential buyers what your business has to offer!

The Importance of Valuation in Preparing to Sell

One often overlooked aspect of preparing to sell a business is the importance of a thorough business valuation. While market timing and readiness are vital, understanding the true value of your business is a game-changer. A professional valuation provides a clear, objective view of what your business is worth, factoring in everything from tangible assets to intangible elements like brand equity and customer loyalty. Why is this essential? It sets realistic expectations for sale price and gives you leverage in negotiations, helping you avoid underselling your hard-earned company.

Furthermore, a detailed valuation helps identify areas of improvement that could enhance your business’s attractiveness to buyers. For instance, if the valuation highlights operational inefficiencies, addressing these issues before going to market could significantly boost your final sale price. Think of it as putting a fresh coat of paint on a house you’re about to sell—it may cost you upfront, but the payoff can be much higher.