How smaller, independent wineries can sell more wine in a hypercompetitive marketplace

State of Industry – Lots of winners but many “silent” losers

It’s amazing how the world can change in a year! Even before the COVID-19 pandemic made its global impact, the U.S. Wine Industry was in a tough spot with oversupply, consumer buying-habit changes, three-tier consolidation issues and more.

Today, these challenges have been dramatically magnified. For smaller, independent wineries across the United States, the time has come to take a serious look at adapting to the rapidly evolving trade and consumer trends shaping the industry. Here are just a few of the most important dynamics to consider in order to successfully compete in the wine marketplace in the years to come.

New packaging – It’s not just a 750ml game anymore

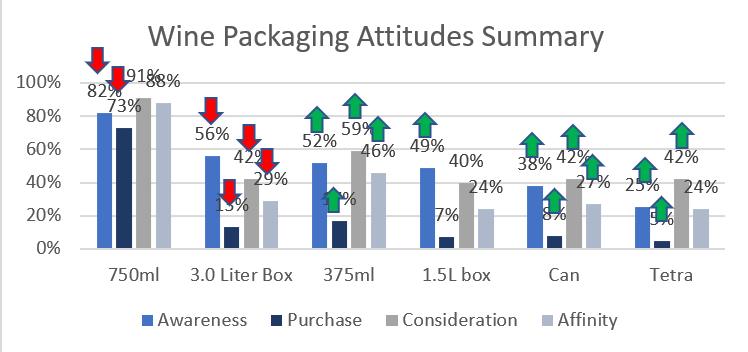

The wine industry is an agriculture business and one that is historically slow to adapt to change. In the last few years, this business paradigm has rewarded producers who are willing to take the risk of packaging their wines in unconventional ways that go beyond standard 750ml bottles.

Many wineries still cling to the belief that quality wines MUST be packaged in 750ml bottles. Some even believe that those bottles should be heavier than standard-weight bottles, in order to convey a high-end image. This thinking does not take into consideration that today’s consumers—across all generations—are more cognizant than ever of the environmental impacts of their everyday purchasing choices. From aluminum cans to 1.5-liter box, here are the top trends in packaging over the last few years:

Cans, boxes, Tetra cartons, 375ml, 500ml … all should be contemplated depending on a winery’s channel focus. These alternative packages are clearly appealing to due to their convenience, sustainability and “avant garde” positioning.

Source: Wine Intelligence – Trade interview program 2020

Wine Types and Styles – Tastes they are a-changin’

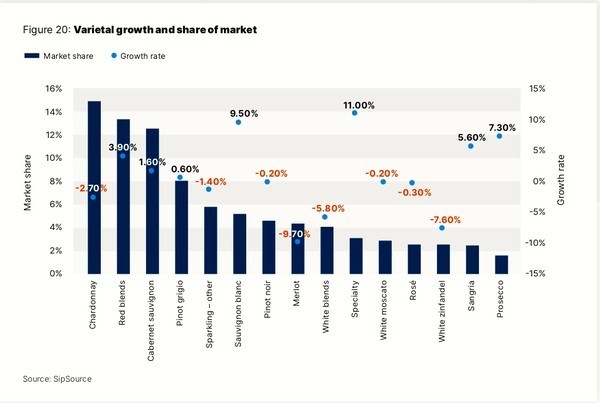

Consumer buying habits change over time for all industries—that’s just the way it goes due to generational shifts, technology advancements and innovations. While the Boomer generation (born ‘55-‘65) has driven wine industry growth and premiumization for the last 30 years, the smaller GenX cohort (born ‘65-‘80) has overtaken it to become the key purchaser of premium wines in the U.S. The Millennial generation (born ‘81-‘96) is right behind the Boomers, in the No. 3 spot. These younger generations have different wine preferences than their parents before them.

As food styles evolve and consumers embrace healthier eating habits, lighter and fresher wines such as Sauvignon Blanc, rosé and Pinot Noir continue to gain in popularity. This trend shows no sign of abating, which means that the sales dominance of Cabernet Sauvignon and Chardonnay will wane. While this can spell trouble for some wineries, it will provide opportunities for those willing to make the jump. (To learn more about this trend, see Ray Isle’s article in Food & Wine.)

But before any winery looks at producing new products, it must first examine its existing portfolio and weed out underperforming SKUs that do not truly contribute to the brand’s success. Slow-moving SKUs weigh on resources and divert attention from products that could become hero wines that drive sales success and profitability

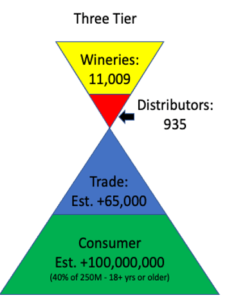

Three-Tier Channel – Consolidation continues

No one could have predicted the catastrophic collapse of the on-premise segment in 2020. For decades, many wineries benefited from a restaurant-focused strategy, but these producers have now been forced to look for alternative sales channels within the three-tier trade.

Retail trade was already controlled predominately by the larger wine companies—those 50-some-odd producers making more than 250,000 cases annually. So, for smaller wine companies looking to make up for lost sales in this channel, it will continue to be extremely difficult to increase sales and distribution, unless they have unique, sought-after or highly rated wines.

The small, independent winery already entrenched in the three-tier marketplace must learn to adapt to selling wine in a whole new manner focused on some of the following principles:

- Focus on account relationships directly, relying less on distributors to generate business. Simplify wholesale pricing nationally so that resulting trade prices between all states show minimal variations, limit ultra-deep online discounting in states like N.Y., N.J., Calif., and Conn.; and have depletion allowances/price supports that are targeted on volume deals vs. everyday pricing.

- Look less at a traditional 50-state distribution plan and adopt a strategic, state-by-state strategy in which the winery’s time and money resources are focused more effectively.

- Focus on distributors that are committed to being transparent, communicate regularly, and are structured to work off depletion and account base goals – not shipments.

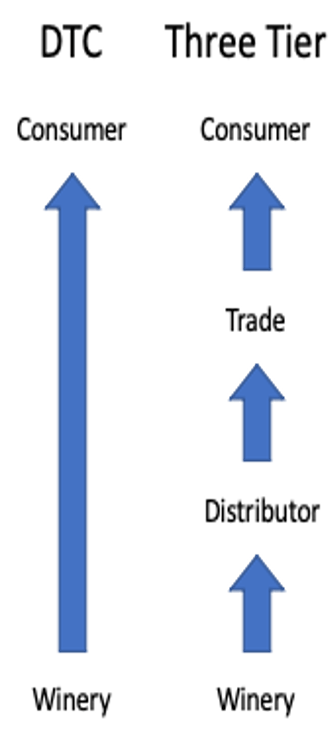

The Winning Game – DTC is clearly the haven but increasingly competitive

Direct-to-Consumer (DTC) is an obvious focus for most small wineries since it’s more of an open marketplace and a more profitable sales channel. That said, there are many competitive realities in to consider:

- Hospitality – Wine tourism will return, but competition for the wine tourist dollar will be fiercer than ever as things open back up. To attract and retain a more customers, wineries should continue to invest in tasting room spaces and staff to elevate their experiences.

- Membership – Because younger generations that have become the wine industry’s dominant buyers don’t necessarily want to have wine shipments show up automatically “X” number of times per year, traditional wine club memberships are declining. When building this important channel, consider fully customizable membership structures, shipping cost supports (including flat fees and/or shipping included) as well as unique added value benefits (not just events)

- eCommerce – Online wine sales got a big boost due to pandemic restrictions, and wineries will need to invest in this channel to keep the momentum going. eCommerce requires resources in digital marketing (website, email, SEO, social media, etc.). Since most wineries don’t have the resources to hire a full-time employee to manage this area, outsourcing is vital. (Just a few of the companies that specialize in providing ecommerce support are:

Wine Glass Marketing, Ving Direct, and Juice Box Direct.)

Don’t Just Survive, Thrive – The strategically minded winery will prevail

The biggest trends in the wine industry today were already wielding their influence well before the pandemic hit, and now the need to develop alternative routes to market is clearer than ever. Wineries must accept the fact that the marketplace has changed, and rapidly adapt to remain relevant to the consumer.

Small, family-owned, independent wineries can not only survive but thrive in today’s hypercompetitive wine industry. However, they will need to develop a sound overall strategy with a realistic operational plan for executing initiatives that fit the winery’s capabilities—financially, operationally and even culturally.

FAQ: How Smaller, Independent Wineries Can Sell More Wine in a Hypercompetitive Marketplace

How can small wineries increase direct-to-consumer (DTC) sales?

Small wineries can increase DTC sales by creating memorable tasting room experiences, building customizable wine memberships, and expanding eCommerce capabilities. Wineries should consider flat-rate or free shipping options to entice more online purchases. A 2021 study revealed that DTC wine sales increased by 27% year-over-year, highlighting the growing importance of this channel .

What packaging options are best for small wineries looking to stand out?

Small wineries can benefit from using eco-friendly, alternative packaging like aluminum cans, Tetra cartons, or smaller bottle sizes (e.g., 375ml, 500ml). These packaging formats are more sustainable and appeal to environmentally conscious consumers. In 2020, canned wine sales alone grew by 68% , making this an area worth exploring.

How can independent wineries attract younger consumers?

To attract Millennials and Gen Z, wineries should focus on producing lighter wines like rosé, Sauvignon Blanc, and Pinot Noir, which align with the younger generations’ preference for fresh, lighter options. Offering virtual tastings or partnering with influencers can also help engage this tech-savvy demographic. According to research, 54% of Millennials prefer virtual wine experiences over in-person events .

What role does eCommerce play in boosting wine sales for small wineries?

eCommerce is critical for wineries looking to expand beyond local markets. Building an intuitive website with strong SEO, offering personalized recommendations, and using email marketing can significantly boost online sales. During the pandemic, online wine sales jumped by 119%, showing the power of digital sales .

What should small wineries consider when choosing distributors?

Small wineries should partner with distributors that offer transparency and regularly communicate. It’s essential to align with distributors who focus on depletion goals, not just shipments. Smaller wineries may also benefit from targeting specific states rather than attempting to distribute nationally .

How can wineries differentiate their products in the crowded marketplace?

Wineries can stand out by producing unique or limited-edition wines, building strong storytelling around the vineyard’s history, or focusing on niche markets like organic or biodynamic wines. A report showed that organic wine consumption grew by 10% in 2022 , indicating the rising demand for these specialized products.

Why are customizable wine memberships more effective than traditional clubs?

Customizable wine memberships allow customers to choose their preferred wines and shipping schedules, which is particularly attractive to younger buyers. Traditional clubs often lock customers into preset shipments, which can deter Millennials and Gen Z. Studies show that flexible memberships increase retention rates by up to 25% .

What wine types are gaining popularity, and how can small wineries adapt?

Lighter wines like Sauvignon Blanc and Pinot Noir are increasingly popular, while the demand for heavy reds like Cabernet Sauvignon is declining. Small wineries should consider expanding their portfolios to include these trending varietals to stay competitive .

How can small wineries thrive despite the consolidation in the wine industry?

Focus on building strong relationships with retail accounts and avoid relying solely on distributors to push your wine. Offering unique products or working with niche markets (like low-intervention or natural wines) can help smaller wineries carve out their own space, even in a consolidating market .

What are some ways smaller wineries can tap into the growing interest in sustainability?

Emphasizing sustainable practices, like using eco-friendly packaging or implementing water-saving vineyard techniques, can attract environmentally conscious consumers. As of 2022, 63% of U.S. wine drinkers said they consider environmental impact when choosing wine .